SPOK - stevehemingway/trading GitHub Wiki

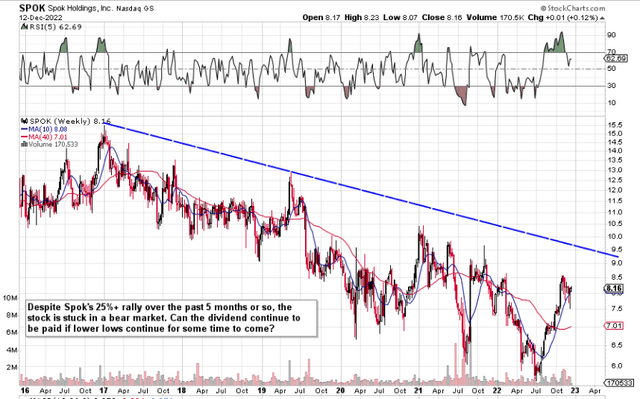

If we pull up a weekly chart of Spok Holdings, Inc. (NASDAQ:SPOK) (Healthcare Communications), we see that shares have been making lower lows for the best part of 6 years now. Although shares have risen almost $2 a share or 25%+ over the past 5+ months or so, we are always mindful of the long-term trend which in Spok's case continues to be bearish. In fact, shares recently broke below their 10-week moving average so the pattern of lower highs and lower lows could very easily repeat itself here in due course.

In saying the above, the lower Spok shares go, the more attractive its valuation invariably becomes. Six years of lower highs and lower lows have resulted in the company's sales multiple now trading at 1.18 over a trailing twelve-month average. Spok also continues to remain cheap from an asset standpoint with shares now trading very close to book value as we stand (Trailing book multiple of 1.05).

Probably the most glaring transformation in this stock over the past 6 years has been the dividend yield. Spok's present yield comes in at 15.34% as opposed to a 5-year average of 5.62%. Suffice it to say, given Spok's very keen valuation and the company's very generous dividend yield, contrarians may see potential here, especially if the company's recurring revenues can continue to hold up going forward. This really is the question though in Spok. Can the dividend continue to be paid out if indeed shares continue to make lower lows for some time to come? Let's delve into the key trends which make up the dividend to see if indeed this can come to pass if needs be.

Spok Technical Chart (Stockcharts.com)

Management raised the quarterly dividend from $0.13 cent to $0.31 cent in March of this year. Therefore the trailing 12-month dividend growth rate tops 113% which is a testament to management really considering how shares have been under pressure for quite some time now. Dividend growth is important as it protects purchasing power and it enables shareholders earn a percentage of the company's earnings.