ASTS - stevehemingway/trading GitHub Wiki

The following is copied from Vince Martin (@overlookedalpha) dated 27 Oct 2022.

We took a long look at shorting ASTS earlier this year. The case is relatively simple. The company aims to provide mobile broadband service via satellite in a manner that can be accessed by standard smartphones. And that’s a model that many bigger, better companies have failed at.

Project Loon from Alphabet was eventually shut down. Facebook gave up on its plan for high-altitude Internet drones. AeroVironment and Softbank have their own similar effort, but it’s not going well.

Meanwhile, ASTS went public via the SPAC (special purpose acquisition company) route. So-called de-SPACs have a strong pattern of overpromising and underdelivering. There was even some sign that the optimism surrounding speculative stocks, so faded elsewhere, was lingering here: ASTS jumped 45% in March after announcing a multi-launch agreement with SpaceX. That was a bizarre rally. ASTS is a potential customer of SpaceX, rather than the other way around.

But, to be honest, that case felt a bit thin, both for this platform and for personal accounts. ASTS had held up well, at least by de-SPAC standards. Perhaps there was something there.

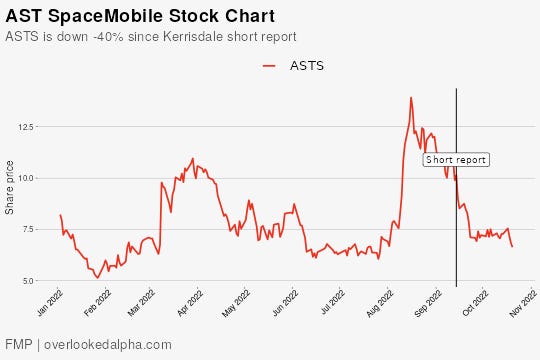

Last month, however, Kerrisdale Capital, an experienced activist short, absolutely eviscerated the stock. The report added specific criticisms to our broad sense that the market was ignoring history, both with the business model and with de-SPACs more broadly. ASTS dropped 11% and has kept falling. It’s lost 40% of its value since publication.

Shorts haven’t gone anywhere, however, and with good potential reason. ASTS still has a market capitalization of $1.2 billion. It still trades about where it did in July. Kerrisdale is making a “short to zero” case, and zero remains a long way away.

It’s been nerve-wracking in recent years to bet against these kinds of stocks (28% of the float is sold short). Cost of borrow is about 18% at the moment, and the options market unsurprisingly is skewed toward the put side.

But there are some potential opportunities in call spreads, and this is a stock that can give way in a hurry. This was a great short idea from Kerrisdale at $10, and it still looks like a good idea above $6.

tags: tags:

- potential/short

- kerrisdale-capital

- overlooked-alpha

The following is copied from Vince Martin (@overlookedalpha) dated 27 Oct 2022.

We took a long look at shorting ASTS earlier this year. The case is relatively simple. The company aims to provide mobile broadband service via satellite in a manner that can be accessed by standard smartphones. And that’s a model that many bigger, better companies have failed at.

Project Loon from Alphabet was eventually shut down. Facebook gave up on its plan for high-altitude Internet drones. AeroVironment and Softbank have their own similar effort, but it’s not going well.

Meanwhile, ASTS went public via the SPAC (special purpose acquisition company) route. So-called de-SPACs have a strong pattern of overpromising and underdelivering. There was even some sign that the optimism surrounding speculative stocks, so faded elsewhere, was lingering here: ASTS jumped 45% in March after announcing a multi-launch agreement with SpaceX. That was a bizarre rally. ASTS is a potential customer of SpaceX, rather than the other way around.

But, to be honest, that case felt a bit thin, both for this platform and for personal accounts. ASTS had held up well, at least by de-SPAC standards. Perhaps there was something there.

Last month, however, Kerrisdale Capital, an experienced activist short, absolutely eviscerated the stock. The report added specific criticisms to our broad sense that the market was ignoring history, both with the business model and with de-SPACs more broadly. ASTS dropped 11% and has kept falling. It’s lost 40% of its value since publication.

Shorts haven’t gone anywhere, however, and with good potential reason. ASTS still has a market capitalization of $1.2 billion. It still trades about where it did in July. Kerrisdale is making a “short to zero” case, and zero remains a long way away.

It’s been nerve-wracking in recent years to bet against these kinds of stocks (28% of the float is sold short). Cost of borrow is about 18% at the moment, and the options market unsurprisingly is skewed toward the put side.

But there are some potential opportunities in call spreads, and this is a stock that can give way in a hurry. This was a great short idea from Kerrisdale at $10, and it still looks like a good idea above $6.