Core Month 04 03 02 Breaker Block - newsqlguru/ict-index GitHub Wiki

ICT Mentorship Core Content - Month 04 - ICT Breaker Block

Key Terms

-

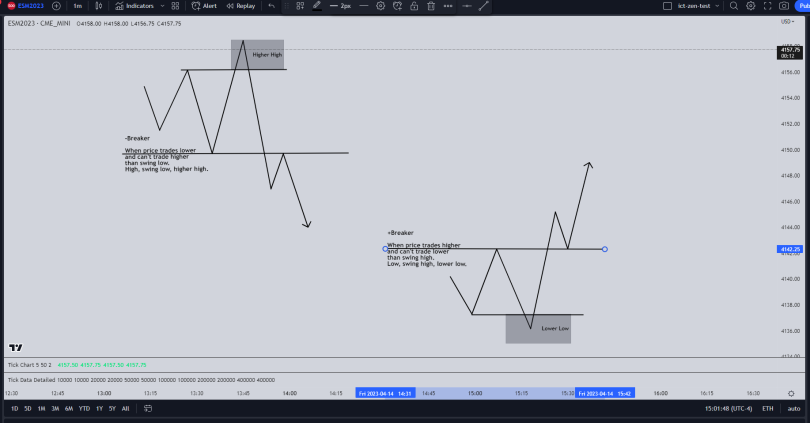

Breaker (+/- BB)

-

Bullish breakers are a short term high between to lows, with the later low trading below the older low.

- The short term high is then traded through and price returns to the short term high, to continue the bullish price swing to a higher high.

- Price shouldn't trade lower than X% of the bullish breaker.

-

Bearish breakers are a short term lows between to highs, with the later high trading above the older high.

- The short term low is then traded through and price returns to the short term low, to continue the bearish price swing to a lower low.

- Price shouldn't trade higher than X% of the bearish breaker.

-

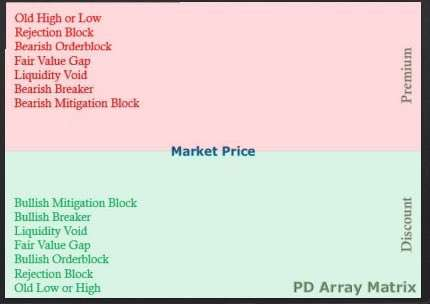

Bearish Institutional Order Flow (-IOF), reference points, Bearish Orderblock, Old high, Old low above current price, Bearish Breaker.

-

Bullish Institutional Order Flow (+IOF), reference points, Bullish Orderblock, Old low, Old high below current price, Bullish Breaker.

Content

-

Trade Setups

-

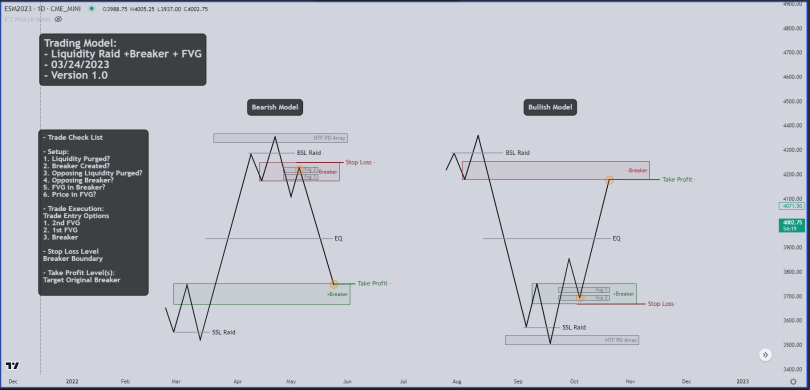

Bullish

-

Ideal conditions in major to intermediate term uptrends.

-

Note +/- IOFs for reference of trade entry and exit targets.

-

Note when price trades lower into our +IOF RP level

-

View the price below short term lows as potential Turtle Soup Long.

-

Should be a SSL Raid, then bullish IOF.

-

Wait for MSS above old short term high and retracement to the short term high that was traded past for the MSS.

-

Focus on the short term high, as there are orders in the high that are looking to be mitigated, shorts look to exit and maybe trade long.

-

+BBs are an up close candle in the most recent swing high, prior to trading through an old low. Sellers that sell the old high and later see the same swing high violated will look to mitigate the loss, when price returns to back to the swing high, this is a bullish trade setup.

-

Bearish

-

Ideal conditions in major to intermediate term downtrends.

-

Note +/- IOFs for reference of trade entry and exit targets.

-

Note when price trades higher into our -IOF RP level

-

View the price above short term highs as potential Turtle Soup Short.

-

Should be a SSL Raid, then bearish IOF.

-

Wait for MSS below old short term low and retracement to the short term low that was traded past for the MSS.

-

Focus on the short term low, as there are orders in the low that are looking to be mitigated, longs look to exit and maybe trade short.

-

-BBs are a down close candle in the most recent swing low, prior to trading through an old high. Buyers that buy the old low and later see the same swing low violated will look to mitigate the loss, when price returns to back to the swing low, this is a bearish trade setup.

-

-

Breaker Key Points

-

Stops will be run after a short term high/low.

-

Repricing will happen after stop run, moving past the short term high/low creating a MSS.

-

Retracements will now be seen as trade entry opportunities.

-

Use highest/lowest candle of short term high/low

-

Use entire range of breaker candle.

Notes

- Find 10 occurrences in past price action and log them in your trade journal.

- Extra credit if found on multiple time frames.