Trade Finance - dennisholee/notes GitHub Wiki

https://101blockchains.com/trade-finance-blockchain/

Src: https://sbci.gov.ie/wp-content/uploads/2015/03/TradeFinanceProducts.pdf

Src: https://ctmfile.com/sections/background/trade-finance

There are two types of trade finance: supplier-centric and buyer-centric.

Supplier-Centric Finance

The main types of supplier-centric financing include:

- inventory finance

- pre-shipment financing:

- for letters of credit, acceptances, bills, evidentiary, e.g. bills of lading

- payment guarantees

- Purchase Order finance

- in-transit/warehouse financing

- receivables finance including forfaiting and export factoring

- post-shipment financing - upon shipment of the goods, suppliers provide the bank with invoice information so loan can be converted into post-shipment financing (sponsored by the buyer).

Many governments also offer programmes that guarantee export working capital facilities to their exporters. With these programmes, the exporters are able to obtain needed facilities from commercial lenders when financing is not available or when their borrowing capacity needs to be extended.

Buyer-Centric Finance

The main types of buyer-centric finance include:

- payables finance/post acceptance financing - covers the period between the creation of a payment obligation by the buyer and the maturity of the payment

- reverse factoring / supply chain finance from banks and the specialist financing platforms

- distributor finance programmes to ensure that distributors can purchase the exporter's goods.

Letter of Credit

A letter of credit is a document from an exporter’s bank to an importer’s bank whereby an exporter will receive payment as long as certain delivery conditions have been met. When an importer accepts a letter of credit, they are acknowledging that they are liable to pay for the exporter’s goods/services. Letters of credit can be guaranteed and in the event that the foreign buyer is unable to make payment on the purchase, the bank will cover the outstanding amount. It is less secure than a Bill of Exchange below.

Letter of Credit Discounting

The exporter asks his bank for earlier payment rather than wait for the importer to pay. The bank discounts (reduces) the payment to the exporter for the early payment benefit.

Bill of Exchange

A Bill of Exchange is a non-interest-bearing written legal order used by exporters that binds their foreign customers to pay a fixed sum of money to another party at a predetermined future date.

Bill of Exchange Discounting

Bill of Exchange Discounting is when a company sells a bill of exchange before its maturity date at a value less than the face value of the bill. The amount of the discount will depend on the amount of time left before the bill matures, and on the perceived risk attached to the bill.

Structured Trade Finance

A business can grow and develop using structured trade finance. It involves using the collateral of the goods its trading, rather than its own balance sheet or other assets. Structured trade finance is a complex arrangement put in place to ensure a bank can take possession and sell the underlying tradable asset(s) used for the loan. A simplified example - a small specialist milk processor exports powered milk to China The processor needs a loan to pay its farmer suppliers for milk, manufacture the finished good from the raw milk, package it for export, ship the finished good to the customer and wait for payment. It cannot fund this from its sporadic cashflow so it utilises a bank to get structured trade finance to fund this specific work-stream from raw material purchasing to receiving payment from the customer. The process from buying the raw material to customer delivery takes a few months. If payment is not received by the bank, the bank will seize the powered milk for the debt.

Invoice Discounting

Invoice discounting is short-term borrowing used to improve a company's cash flow. Invoice discounting allows a business to get money for its individual sales invoices before their customer has actually paid.

Factoring

As with Invoice Discounting, a company using a Factoring provider sells its invoices to that provider for cash but the provider is also responsible for processing the invoices. The business lending the invoices is able to receive loans based on the expected payments on the invoices. Factoring is a more comprehensive service in which the lender includes payment collection and processing as a feature.

Credit Guarantee for Exporters

Credit Guarantees for Exporters are an insurance policy that protects an exporter against nonpayment by their foreign customer (s).

Bond / Guarantee

A Bond or Guarantee gives the importer security of a financial guarantee in the event of the Exporter’s failure to deliver the contracted goods or services. If the Exporter fails to deliver the goods or services as described in the contract with the Importer, the Importer can 'call' the Bond and receive financial compensation.

Advance Payment/Advance Payment Bonds

A bond to cover any advance an exporter may receive from its customer. Usually the advance is used to buy materials to get prepared for a job.

https://www.ledgerinsights.com/blockchain-trade-finance-voltron-hsbc-letter-of-credit/

Src: https://medium.com/@dynamicdhiraj/trade-finance-i-e-5251f9f8be6a

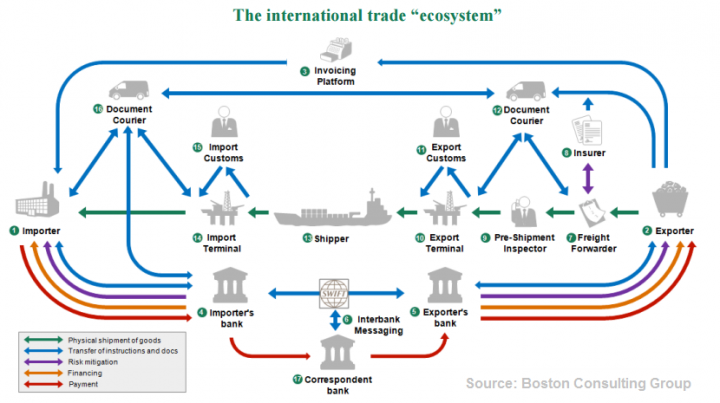

Trade Finance i.e. lending and issuance of Letter of credit(Loc) accounts for approximately 10–20% of the 18.2 trillion$ cross-border trade. The remaining 80–90% of the cross-border trade is settled through open account terms meaning that the importer receives the shipment before paying the exporter.