Global Accounts Receivable Automation Market: Key Players and Emerging Technologies - Market2033/Brainy_Blogs GitHub Wiki

Market Introduction

The global Accounts Receivable (AR) Automation market is experiencing rapid expansion, driven by the increasing need for efficient financial operations and cash flow management across various industries. AR automation solutions streamline invoicing, payment processing, and reconciliation, reducing manual errors and enhancing overall financial efficiency. As businesses prioritize digital transformation, the demand for AR automation is expected to grow significantly in the coming years.

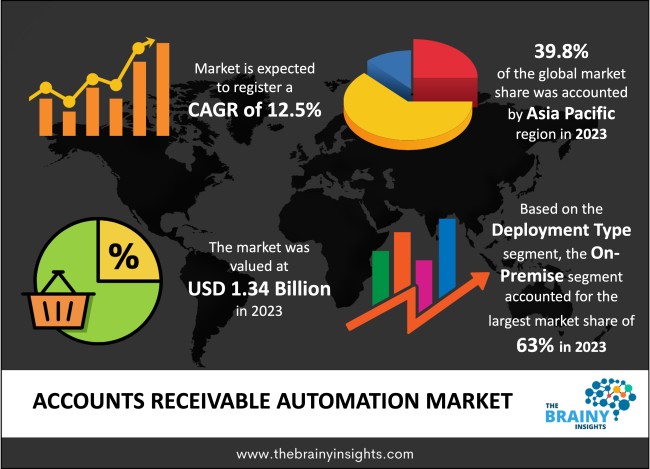

The global accounts receivable automation market is projected to reach USD 3.8 billion by 2033, growing at a CAGR of 12.5% from 2024 to 2033.

Market Dynamics

The AR automation market is propelled by factors such as the rising adoption of cloud-based solutions, integration with artificial intelligence (AI) and machine learning (ML), and the increasing emphasis on compliance and risk management. Businesses are leveraging AR automation to minimize late payments, improve customer relationships, and optimize working capital. Moreover, the surge in e-commerce and globalization is further accelerating the need for seamless AR processes.

However, challenges such as data security concerns, high initial implementation costs, and resistance to change among traditional enterprises pose potential barriers to market expansion. Nevertheless, continuous advancements in financial technology (FinTech) and increasing investments in automation solutions present lucrative opportunities for market growth.

Regional Insights

North America leads the AR automation market, driven by early technology adoption, a strong presence of key market players, and a robust regulatory framework supporting automation in financial operations. Europe follows closely, with stringent compliance norms and a growing preference for cloud-based AR solutions. The Asia-Pacific region is anticipated to witness the fastest growth, fueled by the digital transformation of enterprises, increasing penetration of SMEs, and rising investments in automation technologies.

Challenges and Opportunities

While the market holds immense potential, challenges such as integration complexities with legacy systems and data privacy concerns remain key obstacles. However, the increasing adoption of blockchain technology for secure transactions and advancements in AI-driven predictive analytics offer promising opportunities for market players to innovate and expand their offerings.

Key Trends

- AI and ML-driven automation enhancing accuracy and decision-making.

- Integration of AR automation with Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems.

- Growing preference for cloud-based and Software-as-a-Service (SaaS) solutions.

- Adoption of blockchain for secure and transparent AR processes.

- Emphasis on real-time data analytics and predictive insights.

Key Players Prominent players in the AR automation market

- Sage

- Oracle

- Bottomline technologies

- High Radius

- Financial Force

- Rimilia

- Emagia

- Zoho

- Comarch

- Yay Pay

These companies are investing in AI-powered automation, strategic partnerships, and innovative product offerings to maintain their competitive edge in the market.

Request to Download Sample Research Report- https://www.thebrainyinsights.com/enquiry/sample-request/12695

Conclusion

The Accounts Receivable Automation market is poised for substantial growth as businesses continue to embrace automation for improved financial efficiency. With advancements in AI, cloud computing, and blockchain technology, AR automation is set to become an integral component of financial management strategies worldwide. Market players who capitalize on emerging trends and address key challenges will be well-positioned to lead the industry in the coming years.